Future (FV) Value - Return on Investment Chart Preparation

It's a quick reference present to future value chart preparation tool to find the time value of money or estimate the rate of return on investment or estimate the future sum of money for the present value of money or cash equivalent assuming that the inflation is zero. The two main terms used in this context present value and future value are popularly known as PV and FV respectively. This tool allows the users to prepare the future value chart for a given present value of money invested. It's an improvised version and an alternative to traditional future value calculator to determine the future sum of money based on the range of interest percentage and time period variations. PV to FV chart is available in pdf, excel, printable and downloadable format.

| x | 3.25% | 3.5% | 3.75% | 4% | 4.25% | 4.5% | 4.75% | 5% | 5.25% | 5.5% | 5.75% | 6% |

| 2 Years | 106.71 | 107.24 | 107.78 | 108.31 | 108.86 | 109.4 | 109.95 | 110.49 | 111.05 | 111.6 | 112.16 | 112.72 |

| 2Y 1M | 107 | 107.55 | 108.11 | 108.68 | 109.24 | 109.81 | 110.38 | 110.95 | 111.53 | 112.11 | 112.69 | 113.28 |

| 2Y 2M | 107.29 | 107.87 | 108.45 | 109.04 | 109.63 | 110.22 | 110.82 | 111.42 | 112.02 | 112.63 | 113.23 | 113.85 |

| 2Y 3M | 107.58 | 108.18 | 108.79 | 109.4 | 110.02 | 110.63 | 111.26 | 111.88 | 112.51 | 113.14 | 113.78 | 114.42 |

| 2Y 4M | 107.87 | 108.5 | 109.13 | 109.77 | 110.41 | 111.05 | 111.7 | 112.35 | 113 | 113.66 | 114.32 | 114.99 |

| 2Y 5M | 108.16 | 108.81 | 109.47 | 110.13 | 110.8 | 111.47 | 112.14 | 112.82 | 113.5 | 114.18 | 114.87 | 115.56 |

| 2Y 6M | 108.45 | 109.13 | 109.81 | 110.5 | 111.19 | 111.88 | 112.58 | 113.29 | 113.99 | 114.7 | 115.42 | 116.14 |

| 2Y 7M | 108.75 | 109.45 | 110.16 | 110.87 | 111.58 | 112.3 | 113.03 | 113.76 | 114.49 | 115.23 | 115.97 | 116.72 |

| 2Y 8M | 109.04 | 109.77 | 110.5 | 111.24 | 111.98 | 112.72 | 113.48 | 114.23 | 114.99 | 115.76 | 116.53 | 117.3 |

| 2Y 9M | 109.34 | 110.09 | 110.85 | 111.61 | 112.37 | 113.15 | 113.92 | 114.71 | 115.5 | 116.29 | 117.09 | 117.89 |

| 2Y 10M | 109.63 | 110.41 | 111.19 | 111.98 | 112.77 | 113.57 | 114.38 | 115.19 | 116 | 116.82 | 117.65 | 118.48 |

| 2Y 11M | 109.93 | 110.73 | 111.54 | 112.35 | 113.17 | 114 | 114.83 | 115.67 | 116.51 | 117.36 | 118.21 | 119.07 |

| 3 Years | 110.23 | 111.05 | 111.89 | 112.73 | 113.57 | 114.42 | 115.28 | 116.15 | 117.02 | 117.89 | 118.78 | 119.67 |

| 3Y 1M | 110.53 | 111.38 | 112.24 | 113.1 | 113.98 | 114.85 | 115.74 | 116.63 | 117.53 | 118.44 | 119.35 | 120.27 |

| 3Y 2M | 110.82 | 111.7 | 112.59 | 113.48 | 114.38 | 115.28 | 116.2 | 117.12 | 118.04 | 118.98 | 119.92 | 120.87 |

| 3Y 3M | 111.12 | 112.03 | 112.94 | 113.86 | 114.78 | 115.72 | 116.66 | 117.61 | 118.56 | 119.52 | 120.49 | 121.47 |

| 3Y 4M | 111.43 | 112.36 | 113.29 | 114.24 | 115.19 | 116.15 | 117.12 | 118.1 | 119.08 | 120.07 | 121.07 | 122.08 |

| 3Y 5M | 111.73 | 112.68 | 113.65 | 114.62 | 115.6 | 116.59 | 117.58 | 118.59 | 119.6 | 120.62 | 121.65 | 122.69 |

| 3Y 6M | 112.03 | 113.01 | 114 | 115 | 116.01 | 117.02 | 118.05 | 119.08 | 120.12 | 121.17 | 122.23 | 123.3 |

| 3Y 7M | 112.33 | 113.34 | 114.36 | 115.38 | 116.42 | 117.46 | 118.52 | 119.58 | 120.65 | 121.73 | 122.82 | 123.92 |

| 3Y 8M | 112.64 | 113.67 | 114.72 | 115.77 | 116.83 | 117.9 | 118.98 | 120.08 | 121.18 | 122.29 | 123.41 | 124.54 |

| 3Y 9M | 112.94 | 114 | 115.07 | 116.15 | 117.24 | 118.35 | 119.46 | 120.58 | 121.71 | 122.85 | 124 | 125.16 |

| 3Y 10M | 113.25 | 114.34 | 115.43 | 116.54 | 117.66 | 118.79 | 119.93 | 121.08 | 122.24 | 123.41 | 124.59 | 125.79 |

| 3Y 11M | 113.56 | 114.67 | 115.79 | 116.93 | 118.08 | 119.23 | 120.4 | 121.58 | 122.77 | 123.98 | 125.19 | 126.42 |

| 4 Years | 113.86 | 115 | 116.16 | 117.32 | 118.49 | 119.68 | 120.88 | 122.09 | 123.31 | 124.55 | 125.79 | 127.05 |

| 4Y 1M | 114.17 | 115.34 | 116.52 | 117.71 | 118.91 | 120.13 | 121.36 | 122.6 | 123.85 | 125.12 | 126.39 | 127.68 |

| 4Y 2M | 114.48 | 115.68 | 116.88 | 118.1 | 119.34 | 120.58 | 121.84 | 123.11 | 124.39 | 125.69 | 127 | 128.32 |

| 4Y 3M | 114.79 | 116.01 | 117.25 | 118.5 | 119.76 | 121.03 | 122.32 | 123.62 | 124.94 | 126.27 | 127.61 | 128.96 |

| 4Y 4M | 115.1 | 116.35 | 117.62 | 118.89 | 120.18 | 121.49 | 122.8 | 124.14 | 125.48 | 126.84 | 128.22 | 129.61 |

| 4Y 5M | 115.41 | 116.69 | 117.98 | 119.29 | 120.61 | 121.94 | 123.29 | 124.65 | 126.03 | 127.43 | 128.83 | 130.26 |

| 4Y 6M | 115.73 | 117.03 | 118.35 | 119.69 | 121.04 | 122.4 | 123.78 | 125.17 | 126.58 | 128.01 | 129.45 | 130.91 |

| 4Y 7M | 116.04 | 117.37 | 118.72 | 120.08 | 121.46 | 122.86 | 124.27 | 125.7 | 127.14 | 128.6 | 130.07 | 131.56 |

| 4Y 8M | 116.35 | 117.71 | 119.09 | 120.49 | 121.89 | 123.32 | 124.76 | 126.22 | 127.69 | 129.19 | 130.69 | 132.22 |

| 4Y 9M | 116.67 | 118.06 | 119.46 | 120.89 | 122.33 | 123.78 | 125.25 | 126.74 | 128.25 | 129.78 | 131.32 | 132.88 |

| 4Y 10M | 116.98 | 118.4 | 119.84 | 121.29 | 122.76 | 124.25 | 125.75 | 127.27 | 128.81 | 130.37 | 131.95 | 133.55 |

| 4Y 11M | 117.3 | 118.75 | 120.21 | 121.69 | 123.19 | 124.71 | 126.25 | 127.8 | 129.38 | 130.97 | 132.58 | 134.21 |

| 5 Years | 117.62 | 119.09 | 120.59 | 122.1 | 123.63 | 125.18 | 126.75 | 128.34 | 129.94 | 131.57 | 133.22 | 134.89 |

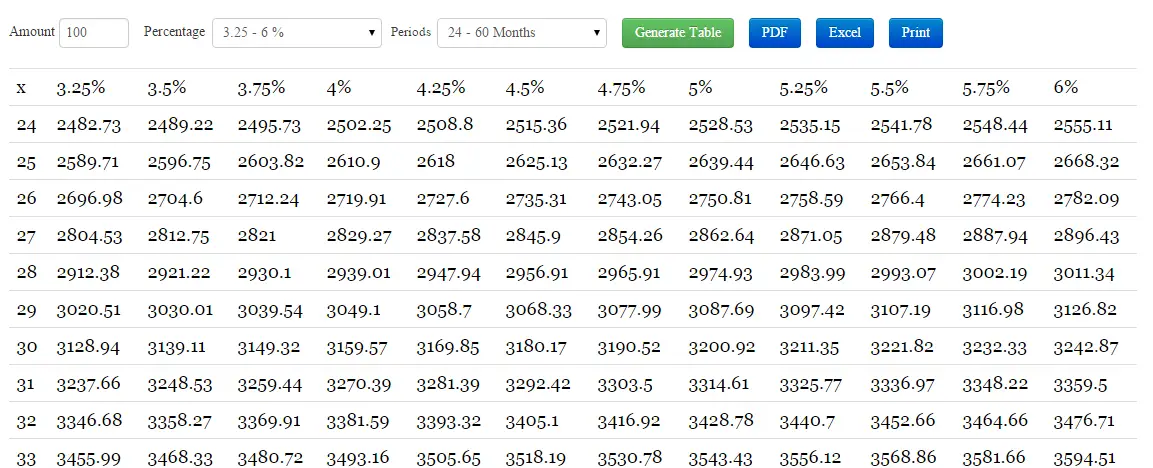

- PV to FV chart

- How it differ from other traditional future value calculator?

- How to use this tool to prepare PV to FV chart?

- How to use this PV to FV chart?

- Future value calculation

- What type of interest calculation used?

- How can investors make use of it?

- How to download a copy of FV chart in pdf?

- How to download a copy of future value chart in Excel?

- How to get a print out of this pv to fv chart?

The investors always look for better rate of return on their investments; therefore calculating future value of the present value of investment becomes essential. A traditional FV calculator only calculates the future sum for a single set of interest rate and time period but in contrast, this PV to FV value chart preparation tool allows users to generate matrix of future values for the different set of interest rate and time period for a certain amount of investment or present value. Like in the XY plot, any one combination of interest rate and time period of this chart represents its equivalent time value of money for the given present value or any future value in the matrix of values represents its equivalent interest rate and time period for the certain present value of an investment. Overall, it's a time value of money let the investors to know future value of present value of money.

To determine the time value of money or future value of certain present value, follow the below steps to prepare present to future value chart based on the different percentage ranges and time period ranges.

- Enter the present value

- Select the percentage range

- Select the Time Period by date range

- Hit Generate table to get the FV table generated

The main purpose of this chart is to provide a better user experience to perform the comparison between the return on investment based on the interest rate and time period of certain present value of money or equivalent. In the generated table of return on investments as future value of present value, look for suitable or desired return on investment and note down the percentage rate which is provided in the first row and time period in number of months provided in the first column of this chart.

To add more insight to the expected rate of return on investment calculation, the future value calculator is integrated with in this PV to FV chart. The generated fv chart contains a matrix of future values to select from. Hit on a desired future value as a return on investment redirect the user to the respective future value calculator for more insight for the selected future value; where user may find detailed fv calculation or more information of how much present value and rate of interest each return on investment employed.

It's very obvious question to ask what type of interest calculation is used in future value chart, whether simple interest or compound interest, when users deal with rate of interest calculation. In pv to fv chart, the compound interest is used to determine the future value of the present value or return on investment.

Any investors who are looking for investment like bonds, securities, etc may use this chart tool to prepare the present to future value chart to determine the overall rate of return on an investment. This chart may be useful for investors to compare the rate of returns between different bonds and securities for a certain present value of money.

This pv to fv chart is available in downloadable format. Users can download this chart alone except other content of this page in the following way.

- Follow the above 4 steps given for How to Use this tool to prepare PV to FV chart?

- Click on the pdf button provided on the top left side corner of this page to get the FV chart alone in pdf format

This future value chart is also available in excel format. Due to technical reasons, this excel format FV chart only available for default values only. This format alone will not support user supplied values.

- Click on the excel button provided on the top left side corner of this page to get the pv to fv chart in Excel format

This pv to fv chart is also available in printable format. The print can be taken in many ways but using the above print button provided on the top left side corner of this page only print the fv chart alone.

- Follow the above 4 steps given for How to Use this tool to prepare an pv to fv chart?

- Click on the Print button to get the FV chart alone